作者:格隆汇精译求精翻译组

有限合伙制企业(MLP)跑步机(注:形容MLP模式是环环相扣的,有循环性)

We arrive at a situation where an incentivefor risky growth is then combined with a reliance on outside funding. Itis this dynamic that leads to the MLP Treadmill.

风险中求增长的动机和对外部资金的依赖结合在了一起,正是这种动力把MLP公司带到了跑步机上。

MLPs constantly need more capital to drivebigger and bigger deals so that they can keep growing distributions. Inturn, bigger distributions will lead to a higher valuation. This is theMLP Treadmill. Once you get on and start feeding growth through externalfunding, it is very hard to stop and get off. And get off you must,eventually.

MLP公司需要源源不断的资金投到更大的项目中,以此提高分红,更高的分红反过来会带来更高的价值,这就是MLP跑步机。一旦你踏进去,开始用外部资金投资促进增长,就很难停下来然后脱身。但是你最终还是得从中脱身。

One of the inherent contradictions of theMLP model is that, if it works exactly as designed, the company will hit the high splits quickly. As the GP grabs a biggerand bigger piece of the pie, the cost of capital will increase commensurately. As one observer put it: “ The Company’s unitprice depended upon constantly increasing dividend distribution, andever-higher dividends, creating ever-greater IDRs, required staggeringinfusions of capital.”

MLP模式固有的矛盾之一是如果按照设计好的剧本走,它很容易到达五五分的那个点。当普通合伙人的份额越来越大,资本成本也会同样增加。一个观察员如是说:“公司的股价取决于不断增加的分红额度,越高的分红能带来越大IDR权利,需要更多的融资。”

For example, below is a look at the 20 yearlifespan of an MLP. We have assumed a 7% yield at the outsetwith an expectation that the yield will grow by 3% per year. Theseassumptions give the MLP an initial cost of capital of 7%. But, by year20, the GP is taking 4q% of distributable cash flow and the MLP must earn 51%on its equity to preserve the distribution growth to LPs. The universeof investments providing that sort of return is rather small.

例如:如下所示是一家MLP企业20年的企业生命周期。我们假设初始收益率是7%,预计收益率每年按3%增长。在这些假设下,MLP企业的初始成本占总资本的7%。但是在第20年时,普通合伙人拿走可分配现金流的4%,MLP企业必须挣得股权的51%以保证有限合伙人分红的增长。而能够提供如此高回报的投资是十分少的。

Kinder Morgan serves as a cautionary tale. Kinder Morgan rode the MLP Treadmill all the way to its logicalconclusion. From 1990 to December 1996, Richard Kinder served as thePresident and COO of Enron Corporation. He resigned from Enron in 1996 afterbeing denied a promotion to CEO. He had a headstrong belief in theprofitability of collecting a toll to move energy through pipelines” which didnot gibe with the more aggressive vision at Enron. After leaving Enron,he and college friend William V. Morgan started a pipeline business. They firstpurchased Enron Liquids Pipeline, a natural gas conduit business that Enron waseager to get rid of, for $40 million. They also merged with KNEnergy. After a number of acquisitions, most prominently El PasoCorporation, Kinder Morgan became the largest midstream energycompany in North America. Enron declared bankruptcy in 2002.

金德摩根公司就是个警示传奇。金德摩根在MLP跑步机上一直跑跑跑,最后的结局也在意料之中。从1990年到1996年12月,理查德·金德担任安然公司(世界上最大的综合性天然气和电力公司之一)的首席运营官。1996年晋升CEO失败后,他从安然公司辞职。他坚定地认为对管道运输石油收取费用是有利可图的。离开安然之后,他跟朋友威廉 V·摩根开始了管道运输的生意。他们首先用4000万美金买下安然石油运输公司,这是安然公司十分想摆脱的负责天然气管道业务的子公司。他们还跟KN能源公司合并起来。金德摩根通过一系列的合并,尤其是跟埃尔帕索公司的合并,变成了北美最大的中游能源公司。安然在2002年宣告破产。

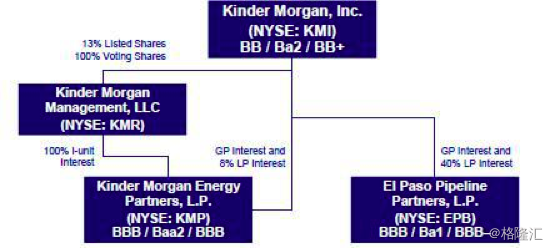

By 2014, the Kinder Morgan empire hadgreatly expanded.

2014年时,金德摩根帝国已经大面积扩张了。

Enron Liquids Pipeline evolved into KinderMorgan Partners (KMP), a master limited partnership. KMP earned themajority of its income by transporting oil, natural gas and CO?through its approximately 52,000 miles of pipelines located throughout theUnited States and Canada. It also owns approximately 180 terminals dedicated tohandling natural resources. The Company owns the physical pipelines, andcollects lucrative fees when natural resource companies use those pipelines totransport their products. KMP had increased its dividend every quartersince its inception.

安然石油管道公司变成了金德摩根的合伙人(KMP)——业主有限责任合伙企业。KMP大部分盈利都来自于遍布全美、加拿大的近52000英里的管道对石油、天然气和二氧化碳进行运输。同时,它还拥有180个终点站以处理自然资源。公司拥有实体的管道,当能源公司利用其管道运输产品时,公司就能收取丰厚的利润。KMP从一开始就实现了每季度的分红增长。

Combined, the Kinder Morgan family was thethird largest energy company in North America, with an estimated combinedenterprise value of ~$140 billion. Among other assets, the Kinder Morganfamily owned the largest natural gas network in North America.

合并之后的金德摩根公司是北美最大的能源企业,企业价值估计为1400亿美元。就其它资产而言,金德摩根母公司拥有北美最大的天然气网络。

Yet on August 10, 2014, Kinder Morganannounced that it was shutting down its MLP and rolling them up into the mainpublic company. Why would they do this?

然而在2014年8月10号,金德摩根宣布关闭MLP公司回归到主要的上市公司里。为什么要这样做?

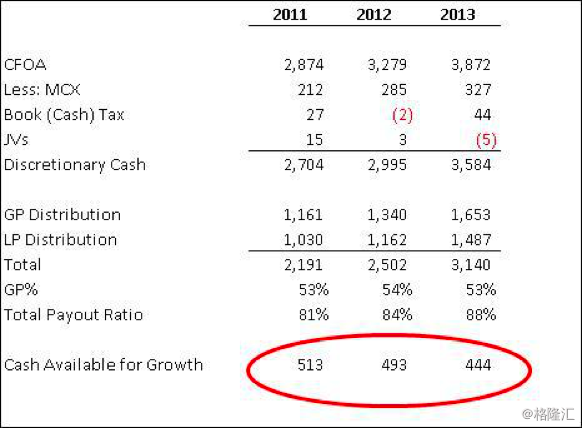

By 2011, its MLP, Kinder Morgan Partners(KMP), was in the high splits. The GP was earning more than 50% of totaldistributions to unit holders. Further, over 100% of cash not neededimmediately by the business was being distributed out. How much did thisleave for growth investments? Not a whole lot:

在2011年时,金德摩根的MLP公司,也即金德摩根合伙公司,就处于高分位点。普通合伙人所得分红高于单位信托合伙人所得分红的50%。再者,公司当时不需要用上的现金几乎100%被分配掉了。这样一来给投资增长留下来的钱还剩多少呢?必然所剩无几。

Kinder Morgan Partners, Discretionary CashFlows, 2011-2013

Source: Company filings via Sentieo.com

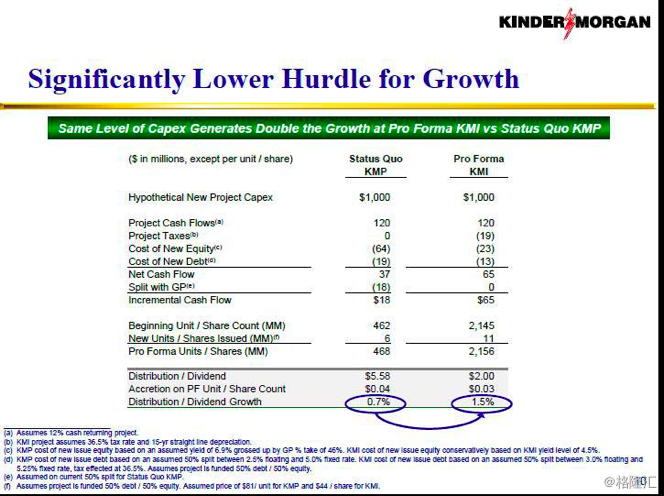

Further, with the GP in the high splits, theMLPs cost of capital was enormous and the corresponding hurdle rate for newinvestments severely limited the universe of accretive investments. Hereis a slide from a Kinder Morgan investor presentation showing the return tominority unitholders and shareholders from a new investment in the MLPstructure and in the more traditional corporate structure:

再者,当普通投资者分红较多时,MLP企业的资本成本很高昂,对应的新投资项目的要求回报率限制了累计投资。如下所示,金德摩根投资者关系展示PPT分别展示了在MLP模式里和更为传统的公司里少数单位信托证券持有者及股东得到的回报。

Kinder Morgan opted to hop off the MLPTreadmill rather than extend the pain. In 2014, they rolled up their MLPsinto the Sponsor, effectively reversing years of drop downs.

金德摩根选择跳下MLP跑步机结束痛苦。2014年时,他们把MLP企业还给了赞助商,从而有效地扭亏为盈。

Conflicts of Interest

利益冲突

When we take a minority position inpublically traded companies, we always face the risk that the business is beingrun for the benefit of the majority owner and to the detriment of minorityowners. However, this risk is dramatically heightened if none of thetraditional protections for minority ownership are in place. Such is thecase with MLPs

一旦我们持有少量上市公司的股份,我们会经常面临公司损耗小股东利益为大股东谋利的情况。一旦小股东没有传统保护措施,这种风险会严重加强。MLP企业就如此。

a. FiduciaryDuty Waived

受托责任免除

As discussed above, MLPs are organized aslimited partnerships rather than the more common corporation. MLPs takefull advantage of the fact that Delaware law does not require GPs to act in thebest interests of the LP. Therefore, as shocking as this sounds, the GPmay act free of any duty or obligation to the MLP or its limited partners. Forexample, the PBFX 10-K states: “Our general partner and its affiliates,including PBF Energy, have conflicts of interest with us and limited fiduciaryduties to us and our unitholders, and they may favor their owninterests to the detriment of us and our other common unitholders.”(emphasis added) This provision alone is enough to scare us away fromMLPs

正如之前论述的,MLP企业采取的是有限责任合伙制,这跟普通的公司制不一样。MLP企业很好地利用了特拉华公司法不要求普通合伙人为有限合伙人的利益服务的规定。因此,即便听起来很耸人听闻,普通合伙人对MLP公司、或者是有限合伙人根本不需要承担任何责任或义务。例如,PBFX的年报中如是说:“我们的普通合伙人极其合伙公司,包括PBF能源公司,同我方有利益冲突,对我方及单位信托承证券持有者承担有限的受托责任。其有可能以损害我方、及我方其他普通单位信托证券持有者的利益来满足其自身利益。”(再次强调)单单这个条款就足以让我们对MLP企业望而却步。

b. IDRsMean That Deals Can Be Accretive To The GP And Not The LP

IDR(激励分配权利)意味着普通合伙人可享受交易的增值性,但是有限合伙人享受不到。

The way IDRs are calculated makes itpossible for actions to be taken that are accretive to the GP but notnecessarily to existing LPs. Distributions paid to the GP are not based on thedistribution per LP unit but the gross distribution to LPs. Therefore,even if the distribution per unit remains the same, the GP will receive agreater distribution. Here is a simplified example:

IDR获得的方式让普通投资者得以采取行动获得增值回报,但是对现有的有限投资者来说并非如此。普通合伙人获得的分红并非基于有限合伙人获得的分红,而是基于所有有限合伙人的总分红所得。因此,即使每个单位分红额度一样,普通合伙人还是能拿到更多的分红。有个简单的例子:

Notice that the equity funded acquisition,results in a 10% increase in the distribution to the GP while the LP remainsthe same.

比如股权出资收购会使普通合伙人的分红增加,而有限合伙人的保持不变。

c. DropDowns Are Not At Arms-Length

下跌并非公平的

Drop downs are often touted as a benefit ofMLPs. For example, the amount of assets available for drop down by theSponsor is used as a rough proxy for the future growth of the MLP. But,drop downs create a terrible conflict of interest. How can aminority owner of the MLP have any assurance that both parties are negotiatinga fair deal?

股价下跌往往被吹捧成是MLP企业所受的益处。比如,赞助者提供的支撑下跌的资产往往被当作促进MLP企业未来增长的大致替代品。但是下跌造成了非常严重的利益冲突。MLP企业的小股东如何能保证双方能协商出一个公平的交易呢。

d. Lackof Voting Rights

没有投票权

Unlike common shareholders, MLP LPs haveseverely restricted voting rights and no vote for the board of directors.

跟普通股东不同,MLP有限合伙人的投票权严重被限制,董事会根本没有投票权。

Other Ways Management Can Rip You Off

管理层欺骗你的其它的方式

Management has several other ways it can ripoff the minority owners

管理层也能通过其它一些方法欺骗小股东.

1. AccountingGames

财务游戏

The most straightforward method managementhas to rip off investors is playing games with the numbers. As statedearlier, MLPs are required to distribute all available cash. However, allavailable cash is not a term defined under GAAP. This gives managementsignificant leeway to pump up the numbers.

管理层欺骗投资者的最直接的办法就是拿数字做文章。 正如我们早先所说,MLP企业必须把所有的可支配现金分配出去。但是所有可支配现金并非GAAP会计准则下有明确定义的一个条款。这就给了管理层很多机会去拿数字做文章。

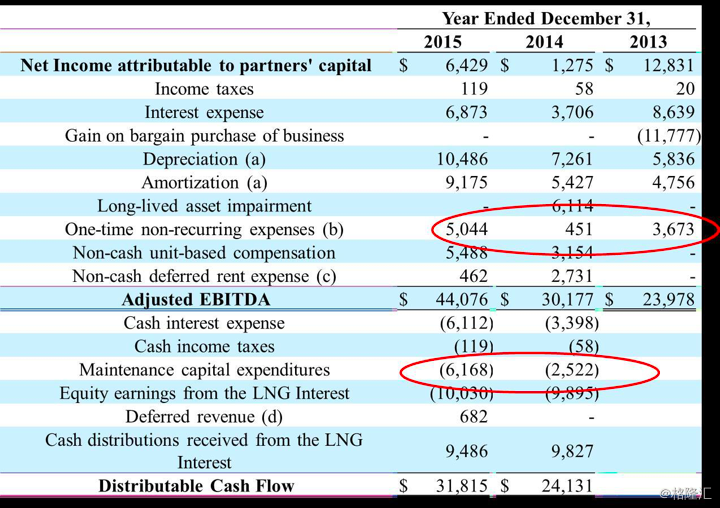

Below is a typical calculation of distributablecash flow by an MLP.

下面是一家MLP公司典型的计算可自由支配现金的方式。

Source: ARCX 10-K

A couple of items stick out. First,the “one-time non-recurring” expenses sure do seem to recur a lot. Buteven more importantly, they are true expenses and a reduction to cash. Why are they being added back?

有几个条款很醒目。首先是“一次性非经常性”开销确实经常出现。但更重要的是它们都是实打实的花销,是对现金的消耗,为什么又被加了回来?

Second, “maintenance capital expenditures”is not a term defined under GAAP. This gives management a lot of leewayto play around with the numbers. Per the 10-K, management simply definesmaintenance capital expenditures as “(i) clean, inspect and repair storagetanks; (ii) clean and paint tank exteriors; (iii) inspect and upgradevapor recovery/combustion units; (iv) upgrade fire protection systems;(v) evaluate certain facilities regulatory programs; (vi) inspect andrepair cathodic protection systems; (vii) inspect and repair tankinfrastructure; and (viii) make other general facility repairs asrequired.” This last point is vague enough to cover (in good years) ornot cover (in bad years) just about any capital expenditure.

第二,“维护资本支出”也并非GAAP会计准则里有确切定义的项。这给管理层很大空间玩弄数字游戏。每一份年报中,管理层都单纯地对维护资本开支给出这样的定义:“(i) 清洁、检查、修理储罐;(ii) 清洁和粉刷罐表面;(iii)检查升级蒸汽回收和燃机组;(iv)升级火力保护系统;(vi) 检查和修复阴极保护系统;(vii)检查和修复储存设施;(viii)按要求修复其它设施。” 最后的模糊项足够覆盖掉(在收益不错的年份里)任何资本开支,或者不包含(在收益差的年份里)这些资本开支。

Maintenance Capex, however, is intended torepresent the cost inherent in maintaining the Company’s current capacity, andis generally funded from operating revenues. Because of that, expendituresclassified as Maintenance Capex reduce the funds that may be distributed to thegeneral partner and the unitholders. The GP has a powerful incentive toclassify whatever expenses possible as Expansion Capex, as that leads to alarger payment for the GP.

但是维修预算本该是维护公司现有运作能力的开支,它应该来自于运营收入。因此,被归作维修预算的成本应该减去本该分配给普通合伙人和单位信托证券持有人的现金。普通合伙人有强大的动机将一切花销都尽可能归类为维修预算,这样以来分给普通合伙人的利润会更高。

Depreciation, depletion and amortization(“DD&A”) costs—reflective as they are of the anticipated expense ofmaintaining assets—should roughly mirror Maintenance Capex. Defying logic, theMLPs we looked at all had Maintenance Capex amounts far lower than theirDD&A. In fact, the average ratio in 2015 was just 30%.

折旧,损耗,摊销费用(“DD&A”)——反映了预期的资产维修费用—跟维修预期大致成正比。我们观察到的MLP企业不符合此逻辑,其维修预期费用都远远低于DD&A费用。事实上,2015年的平均比率才到30%。

2. LongTerm Contracts can mask deteriorating economics.

1. 长期合约可以掩盖经济衰退现象。

One of the strengths of MLPs is therelong-term contracts. This gives investors visibility far into the futureand makes projecting future cash flows easier and more reliable. It alsogives the business financial stability. But, long term contracts are atwo-edged sword. Sure, it’s great to have the predictability, but whathappens when the contract ends? Will the MLP be able to negotiate a renewalon same or better terms or will the customer walk away altogether? Longterm contracts can paper over deteriorating economics until investors get arude awakening. Particularly in a business as cyclical as oil and gas,future economics can look far different than the present.

MLP企业的优势之一就是长期合约。投资者可以借此洞察未来,也可更方便、更可靠地对未来现金流的使用情况进行计划。长期合同也让企业在财务上更加稳健。但是长期合同是把双刃剑。诚然,有可预见性是极好的,可是一旦合同到期会怎样呢?MLP企业可以协商续签同样的条款、或者签下更好的条款吗?还是有可能损失掉所有的客户呢?长期合同可以掩盖住下滑的经济,直到将来投资者才恍然大悟。尤其是在油气这种周期性行业里,未来的经济状况可能和现在完大不相同。

3. MidstreamCompanies Still have Commodity Exposure

3.中游的企业还面临着大宗商品的影响

While it is certainly true that midstreamcompanies do not have direct exposure to commodity pricing, the commodity cyclestill impacts their business. For example, storage businesses do better whenforward prices are higher than current spot rates, a situation known as“contango.” Contango increases storage needs because oil companies knowthey get more money by waiting than by selling it immediately. The GP hasfiduciary duty first and foremost to its own shareholders, not to the LPs.Because the GP has almost complete control of the MLP in any decision makingprocess, the GP can maximize its own benefits ahead of or even to the detrimentof the LP.

的确,中游的企业跟大宗商品的价格并无直接关系,但是大宗商品的周期性仍然对其行业有影响。例如,在期货价格高于当前汇率水平时,存储生意更有利的,这种情况称为“期货溢价”。期货溢价抬高了存储需求,因为石油公司了解按兵不动比立马卖出更赚钱。普通合伙人有首要受托责任,最重要的是对自己的股东而不是对有限合伙人有这个责任。因为普通合伙人对MLP企业的所有决策过程几乎有完全的控制权,所以普通合伙人可以将自己的利益摆在首位,甚至是以牺牲有限合伙人的利益为代价。

A Closer Look At WPT

近距离观察WPT(World Point Terminals)

While combing through the wreckage of theMLP sector, we did come across one company that looks pretty good, WPT:

我们在MLP的残骸里四出搜寻,终于发现了一家看上去不错的企业,WPT:

Most importantly, WPT management seems toreject the idea of hopping on the MLP Treadmill. It has never increasedits distribution. It has distributed the minimum quarterly dividend eachquarter since going public in August 2013. Because the distribution hasnot grown, the company has not triggered any distributions on the IDRs. Further, it has not taken any debt to fund growth investments and has onlyparticipated in one dropdown transaction.

更重要的是WPT的管理层似乎不太愿意跳上MLP的跑步机。它从未提高过分红,自2013年上市一来,它一直在按最低季度股息分红。由于分红并未增加,该公司并未通过IDRs触发分红。再者,它也并未通过借债进行增长投资,“下放交易”(注:母公司将项目移交到MLP企业中)也只参与过一次。

As one might expect, Wall Street is nothappy about this. On the Q4 2014 conference, the following exchange tookplace:

如你所料,华尔街对此并不喜闻乐见。在2014年Q4的电话会议上,发生了以下事情:

Eric Wolff, Hawk Ridge Partners – Analyst

埃里克·沃尔夫,鹰岭合伙人——研究员

I appreciate the conservative nature of thebalance sheet. At the same time, I think your business is relatively stable,and one could argue that a very, very modest amount of debt, even if it’s justone or two times, is exceptionally safe, given the stability of the assetshistorically. What’s been the aversion to even taking on a modest amount ofdebt?

我很欣赏资产负债表的务实风格。同时,我认为贵司相对来说是稳健的,考虑到贵司资产历来的平稳性,一至两倍这样极低的债务水平都是异常安全的。为何贵司不愿意承受适当的债务呢?

J.Q. Affleck, World Point Terminals, LP – VPand CFO

J.Q.阿弗莱克,World Point Terminals, 有限合伙人—副主席,CFO

Well, I think that’s kind of been a messagefrom our Board that we do like operate in a very conservative nature. I thinkthere’s a premium on having some flexibility in the business. As you’ve seenthe capital markets kind of freeze up for MLPs, we feel like we’re in a verystrong position to have the access to the funding through our debt facility asopposed to maybe being at that one or two times level that you speak of, andthen having to access the capital markets if we wanted to maintain that ratio.So I think it’s just kind of the conservative and flexibility aspect that we’vebeen looking at to provide that opportunity for us.

好的,我认为公司偏好保守运营实则是董事会传达的理念。我觉得在业务的灵活性上还有发展空间。如你所见,资本市场在MLP企业这儿基本上是冻结了,我们觉得公司在借债集资方面地位强劲,跟您所说的一到二倍的债务水平恰好相反,我们必须进入资本市场以维持这个比率。所以我们只是希望以保守、灵活的方式来获取机会。

Nevertheless, an investment in WPT takes alot of faith in management.

不仅如此,WPT的每一项投资都需要管理层强大的信念。

For example, the sponsor, Apex Oil Company,is not public. As a result, you must accept management’s assertions thatthey are doing just fine. For example, on the Q4 2015 conference call,the CFO stated: “Apex obviously does not disclose its financials, but ithas done very well during the recent market conditions, and we consider them tobe a very strong — very strong from a credit perspective. We’re not really in aposition to disclose kind of their debt balances or any specifics with regardto their financials, but we don’t see them as posing any risk.”

例如,赞助商Apex石油公司,一个非上市公司。结果是你必须相信管理层所说的该公司经营良好。例如,2015年第四季度的电话会议上,CFO说到:“Apex显然没有披露其财务信息,但是在最近的市场环境里公司发展良好,我们认为公司在信贷评级上十分良好。我们并不是在披露其债务状况、或者任何财务数据,我们认为公司不具有任何风险。”

Second, the Company has exercised a greatdeal of discretion in undertaking acquisitions. However, one of theirstated objectives is to grow via third party deals. How long will theywait for their fat pitch? Will they get impatient and make avalue-destroying acquisition?

其次,公司在并购方面考虑得十分周到。其目标之一们希望通过第三方并购促进增长。他们什么时候才能等来好球?他们会按耐不住做出贬损价值的并购案吗?

Third, as described above, WPT and itscompetitors all assert that they have limited competition because of the uniquelocation of their assets and the lack of suitable substitutes for competitors.

第三,如上所述,WPT及其竞争对手都称自己面临的竞争有限,因为资产有独特的地理位置优势,对竞争对手而言合适的替代者不多。

Nevertheless, on page 63 of the latest 10-K,WPT states: “Despite these barriers, there has been significantnew constructionof residual fuel storage facilities along the GulfCoast in recent years, which we believe may account for some of theunutilized storage capacityat our Galveston terminal.” (Emphasis added.) We wrote to a member of the board of directors as wellas Investor Relations seeking a reconciliation of this seemingcontradiction. We received no response.

但是在最新的年报上,WPT在第63页表明:“尽管障碍存在,但今年有大量的新的石油存储设施在高夫海岸线修建,我们相信能为尚未开发的加尔维斯顿码头的存储能力添砖加瓦。”(特此强调)我们跟董事会中的一名成员、以及投资者关系部门写信,试图给这个可能的矛盾寻求和解。但是我们并未收到回复。

Any MLP’s management is at best a benevolentdictatorship. It has at its disposal all of the tools above. Sofar, WPT has simply chosen not to use them to a great extent.

MLP企业的管理层最多也只是仁慈的独裁家。上面提到的方法都可供其使用。到目前为止,WPT只是单纯地选择最大程度避免使用这些方法。

When The Boring Is Made Exciting, Lookout!

无趣被包装得有趣,要小心了!

When operating properly, midstream companiesshould be stable and boring. They are a utility-like business that shouldbe valued like a utility. Not content with utility-like valuations, WallStreet attempted to make them more exciting. When Wall Street makes theboring look exciting, investors should hold on tight to their wallets.

只要经营良好,中游的企业应当是平稳又无趣的。它们类似于公共设施企业,也应当被当作公共设施企业来估值。但是华尔街并不满足于用公共设施企业的那套估值方法,他们希望让中游MLP企业看上去更性感。华尔街突然让无趣的东西变得性感时,投资者就要好好抓紧自己的钱包了。

As demonstrated above, the growth indistributions was not sustainable. But even with the drop in the price ofoil and the collapse in valuations, MLPs are still unattractive due to thecomplicated structure and the poor incentives it creates.

如上所述,分红的增长并不是可持续的。但即便油价下跌,价值崩塌,MLP企业看上去仍旧没有吸引力,因为它的结构很复杂,创造出的激励机制也不完善。

[1]Another option is to reduce thequarterly dividend. Boardwalk Pipeline Partners did just that and saw itsmarket capitalization drop by 50%.

[1] 另外一个选择就是降低每季度的分红。Boardwalk Pipeline Partners降低过,市值跌了50%。

[2]It’s odd to root for a stagnantdistribution but such is the upside down world of MLPs.

[2]虽然宁愿分红停滞不前有些奇怪,但是在MLP的世界里就是要颠倒过来。